POWELL’S KEY COMMENTS:

- The Fed chairman embraces a hawkish stance and indicates that the FOMC terminal rate will likely be higher than initially anticipated

- Powell says the central bank will stay the course until the job is done and that the bank is prepared to accelerate the pace of tightening in light of inflation risks

- The U.S. dollar extends gains after Powell’s remarks cross the wires, bolstered by the hawkish repricing of the central bank’s monetary policy outlook

Most Read: Central Banks and Monetary Policy: How Central Bankers Set Policy

Jerome Powell appeared today before the U.S. Senate Committee on Banking, Housing and Urban Affairs to deliver the Federal Reserve’s Semiannual Monetary Policy Report, kicking off his two days of appearances on Capitol Hill.

In prepared remarks, the Fed chief embraced a hawkish position, reiterating that the central bank is committed to restoring price stability and will stay the course until the job is done, a sign that borrowing costs will continue to climb for the foreseeable future in the U.S. economy.

Powell also warned Congress that resilient economic activity poses upside inflation risks and that determined measures will be required to tame them. Further, the central bank chief stated that the FOMC terminal rate is likely to settle higher than initially anticipated and that policymakers are prepared to increase the pace of tightening if needed.

Focusing on the outlook, Powell said that officials will make their decisions meeting by meeting, based on the totality of incoming data. At the same time, he cautioned that there are little signs of disinflation in core services excluding housing, and that a softer labor market may be needed in order to win the fight against inflation.

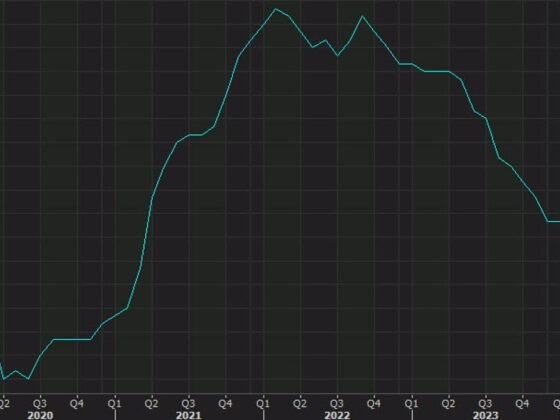

Immediately after Powell’s remarks crossed the wires, the U.S. dollar extended its advance as the short-end of the Treasury curve moved higher, along with expectations for the FOMC’s peak rate, as shown in the chart below. Fed swaps also repriced to favor a 50 bp hike in March over a 25 bp move, a clear indication more forceful actions may be on the horizon in response to sticky inflationary pressures. Monetary policy dynamics are likely to be bullish for the U.S. dollar in the near term, suggesting that the DXY index could prolong its recovery this month.

2023 FED FUNDS FUTURES IMPLIED YIELDS, US DOLLAR CHART

UPDATE US DOLLAR (DXY) TECHNICAL ANALYSIS

In terms of technical analysis, the U.S. dollar (DXY) daily chart shows that price has broken above an important trendline resistance in play since October 2022, reinforcing the greenback’s near-term positive bias. With this bullish breakout, the focus shifts to January’s high at 105.63, the next ceiling to keep an eye on. If bulls manage to clear this level, we could see a move towards 106.18, the 38.2% Fib retracement of the September 2022/February 2023 slump. On the flip side, if sellers return and trigger a pullback, initial support appears at 104.90, and 104.00 thereafter.