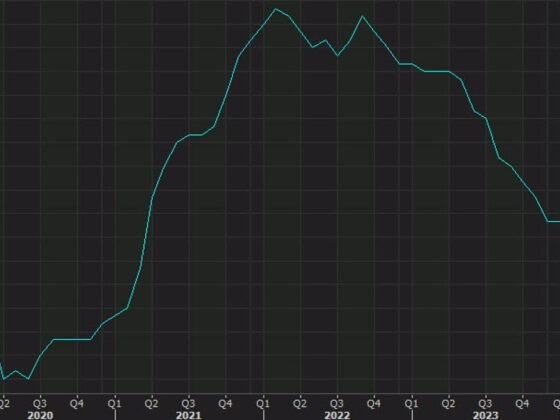

Economists at Danske Bank maintain their strategic case for a lower EUR/USD and thus keep their downward sloping profile forecasting the pair at 1.02 in six-to-twelve months.

Lower on tighter financial conditions

“We have long argued the strategic case for a lower EUR/USD based on relative terms of trade, real rates (growth prospects) and relative unit labour costs.”

“We increasingly think there is a potential for the cross to also head lower on a short-term horizon driven by the market realisation that financial conditions need to tighten, relative rates as well as relative asset demand. Financial conditions have indeed tightened recently which help explain the drop in EUR/USD, but we think more could come and keep our forecast profile intact.”

“New energy/real rate shocks are required for a return all the way to the September lows.”