- EUR/CHF abandons the area of 3-week highs near 1.0000.

- The SNB hiked rates by 50 bps, matching consensus.

- The SNB leaves the door open to extra hikes in the near future.

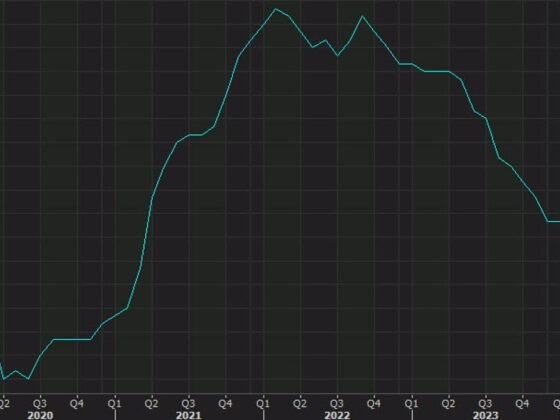

The Swiss franc regains traction and drags EUR/CHF to the 0.9930 region in the wake of the SNB interest rate decision on Thursday.

EUR/CHF: Gains look limited near 1.0000

EUR/CHF comes under pressure and retreats from earlier 3-week highs in levels just shy of the parity following the 50 bps rate hike by the SNB at its meeting on Thursday.

The central bank revised up its inflation projections and now sees consumer prices rising 2.6% this year and 2.0% in 2024 vs. previous forecasts at 2.4% and 1.8%, respectively.

Regarding the GDP, the SNB suggests the economic growth is likely to remain modest for the remainder of the year and the economy is seen expanding 1.0% in 2023 (vs. the December forecast at 0.5%).

The SNB also hinted at the view that inflation could return yo more moderate levels over the medium term in response to the current monetary policy stance and the slower pace of the economic activity.

EUR/CHF significant levels

As of writing the cross is losing 0.02% at 0.9950 and the breach of 0.9836 (200-day SMA) would expose 0.9705 (2023 low March 15) and then 0.9643 (weekly low October 12 2022). On the flip side, the next resistance appears at 0.997 (weekly high March 23) seconded by 1.0041 (monthly high March 2) and finally 1.0097 (2023 high January 13).