- S&P Global Manufacturing and Services PMIs rose more than expected in February.

- US Dollar Index clings to strong daily gains above 103.00.

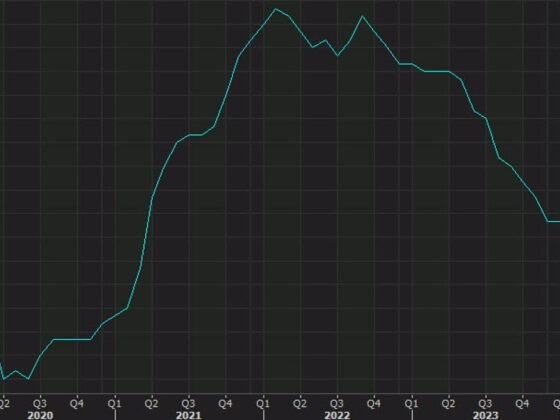

The business activity in the US private sector expanded at a strengthening pace in March with the S&P Global’s Composite PMI rising to 53.3 from 50.1 in February.

S&P Global Manufacturing PMI recovered to 49.3 from 47.3 in February but remained in the contraction territory. Finally, the Services PMI rose to 53.8 from 50.6, surpassing the market expectation of 50.5 by a wide margin.

Commenting on the data, “March has so far witnessed an encouraging resurgence of economic growth, with the business surveys indicating an acceleration of output to the fastest since May of last year,” noted Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Regarding inflation dynamics, “there is also some concern regarding inflation, with the survey’s gauge of selling prices increasing at a faster rate in March despite lower costs feeding through the manufacturing sector,” Williamson explained. “The inflationary upturn is now being led by stronger service sector price increases, linked largely to faster wage growth.”

Market reaction

These data don’t seem to be having a noticeable impact on the US Dollar’s performance against its peers on Friday. As of writing, the US Dollar Index was up 0.6% on the day at 103.20.