- US Dollar stays relatively resilient against its major rivals on Monday.

- US Dollar Index clings to modest recovery gains following Friday’s sharp decline.

- US labor market showed signs of a cooldown in June.

The US Dollar (USD) holds its ground against its major rivals at the beginning of the week after having suffered heavy losses late Friday. The US Dollar Index, which measures the USD’s performance against a basket of six major currencies, clings to modest recovery gains at around 102.50.

The USD came under strong selling pressure ahead of the weekend after the monthly jobs report published by the US Bureau of Labor Statistics revealed signs of a cooldown. Nonfarm payrolls (NFP) rose 209,000 in June, less than the market expectation for an increase of 225,000. Additionally, May’s increase of 339,000 got revised lower to 306,000. Other details of the publication revealed that the Unemployment Rate edged lower to 3.6% while annual wage inflation held steady at 4.4%.

The US economic docket will not feature any high-tier data releases on Monday and the USD’s valuation could be influenced by Federal Reserve (Fed) officials’, including San Francisco Fed President Mary Daly and Cleveland Fed President Loretta Mester, comments. Later in the week, June inflation data could trigger the next big action in the USD.

Daily digest market movers: US Dollar holds steady to start the week

- Commenting on the US jobs report, “I expect the US Dollar to remain on the back foot, but to hold some of its ground,” said FXStreet Analyst Yohay Elam. “The mix of weak job growth and wages marching forward shifts the focus to next week’s Consumer Price Index (CPI) report.”

- In an interview with CNBC on Friday, Chicago Federal Reserve Bank President Austan Goolsbee noted that the jobs market was still strong but cooling.

- Over the weekend, US Treasury Secretary Janet Yellen said that she had “direct” and “productive” discussion with senior Chinese officials. However, “the US and China have significant disagreements,” Yellen added.

- The 10-year US Treasury bond yield edges lower but holds comfortably above 4%. US stock index futures trade in negative territory, pointing to a bearish opening in Wall Street on Monday.

- Despite the mixed jobs report, markets are still pricing in a more-than-90% chance of the Fed raising the policy rate by 25 basis points in July. The probability of the Fed hiking the interest rate again after July stands at around 30%.

- In a recently published report, “the Dollar provides one of the highest yields of the world’s major currencies, thanks to the Fed’s hiking cycle,” said Morgan Stanley analysts. “In a world of weak global growth, this yield will also likely help the Dollar to appreciate.”

- On a yearly basis, the US CPI is forecast to rise 3.1% in June, following May’s increase of 4%.

Technical Analysis: US Dollar Index remains technically bearish

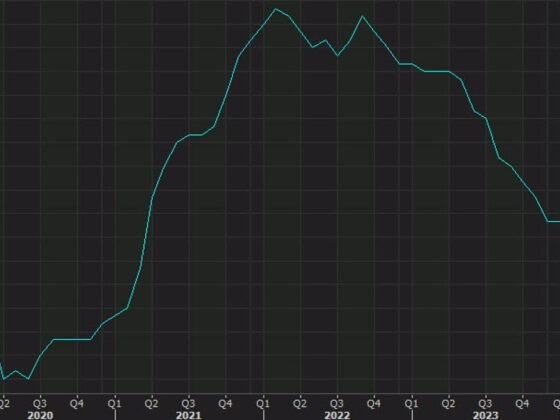

The US Dollar Index (DXY) closed below the 100-day Simple Moving Average (SMA) on Friday and the 20-day SMA made a bearish cross with the 50-day SMA. Furthermore, the Relative Strength Index (RSI) dropped below 50 after having moved sideways near that level in the past couple of weeks.

On the downside, 102.00 (psychological level, static level) aligns as key support. A daily close below that level could attract sellers and open the door for an extended slide toward 101.50 (static level) and 101.00 (static level, psychological level).

Strong resistance seems to have formed at 103.00 (100-day SMA, 50-day SMA, Fibonacci 38.2% retracement of the May-June uptrend). If the DXY rises above that level and starts using it as support, it could target 103.50 (Fibonacci 23.6% retracement) and 104.00 (psychological level) next.

How does Fed’s policy impact US Dollar?

The US Federal Reserve (Fed) has two mandates: maximum employment and price stability. The Fed uses interest rates as the primary tool to reach its goals but has to find the right balance. If the Fed is concerned about inflation, it tightens its policy by raising the interest rate to increase the cost of borrowing and encourage saving. In that scenario, the US Dollar (USD) is likely to gain value due to decreasing money supply. On the other hand, the Fed could decide to loosen its policy via rate cuts if it’s concerned about a rising unemployment rate due to a slowdown in economic activity. Lower interest rates are likely to lead to a growth in investment and allow companies to hire more people. In that case, the USD is expected to lose value.

The Fed also uses quantitative tightening (QT) or quantitative easing (QE) to adjust the size of its balance sheet and steer the economy in the desired direction. QE refers to the Fed buying assets, such as government bonds, in the open market to spur growth and QT is exactly the opposite. QE is widely seen as a USD-negative central bank policy action and vice versa.