- USD/JPY has stretched its losing spell ahead of US inflation data.

- Rising expectations that interest rates by the Fed will peak sooner have infused optimism among investors.

- Japanese Yen is holding strength despite softening of PPI data.

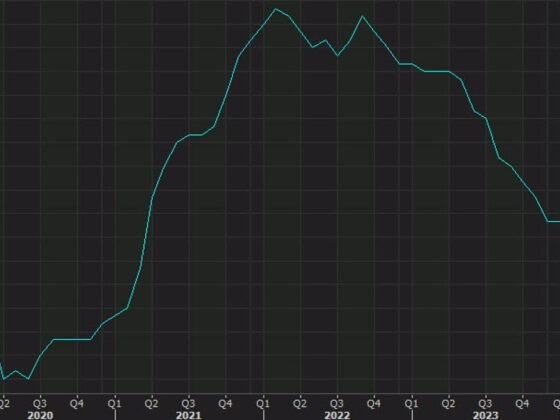

The USD/JPY pair has continued its losing spell for the fifth trading session on Wednesday. The asset has perpendicularly dropped below the crucial support of 140.00 following the footprints of the US Dollar Index (DXY).

S&P500 futures have added some gains in Asia, following positive cues observed on Tuesday. Rising expectations that interest rates by the Federal Reserve (Fed) will peak sooner have infused optimism among market participants.

The US Dollar Index (DXY) has extended its correction swiftly to near 101.37. The USD Index was enjoying the status of cautious market mood due to aggressive policy-tightening from the Fed but now expectations that only one interest rate hike has left in the quantitative toolkit, are weighing burden on it.

Going forward, a power-pack action is expected ahead of the United States Consumer Price Index (CPI) (June) data. Analysts at Credit Suisse expect monthly core CPI inflation to step meaningfully lower in June to 0.2%. The decline would be welcome for the Fed since core inflation has seemingly been stuck around a monthly run rate of 0.4% so far this year. Annualized reading of core inflation is likely to decline to 4.9%, with headline inflation coming in at 3.1% annually, continuing its path toward the target.

The Japanese Yen has flexed its muscles despite Producer Price Index (PPI) figures for June missed estimates. Prices of goods and services have contracted by 0.2% at factory gates vs. expectations of 0.1% expansion. Annualized PPI has decelerated to 4.1% against the consensus and the former release of 5.1%.