The executive behind Equinox Gold took the stage at VRIC to discuss why he is bullish on metals and mining equities in 2023.

A Canadian mining executive and longstanding figure in the resource industry believes a substantial turnaround is coming for both the metals and companies focused on the commodities space.

Ross Beaty, chairman of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX), spoke in front of a packed audience at the recent Vancouver Resource Investment Conference (VRIC) to share his sentiment on the overall mining sector.

Beaty is a celebrated presence in the resource market, having been inducted into the Canadian Mining Hall of Fame back in 2018.

During a conversation with Jay Martin, president of Cambridge House, the company builder said he expects Equinox Gold to be his “last company.” The firm recently celebrated its fifth anniversary, and in discussing Equinox’s progress, Beaty told the audience he sees the company as close to being able to measure real success with its gold production in Ontario.

He also explained why he is concerned about investor evaluations and shared what makes him believe virtually every metal is in a position of strength right now.

How to handle resource market volatility

As VRIC host Jay Martin reminded the room, this year’s conference was packed with newcomers to the mining investment space. With that in mind, his discussion with Beaty began with advice on how to deal with market volatility.

“The one thing investors sort of forget is that it’s cyclical,” Beaty said, referring to the waves of high performance in stocks followed by downturns in the market, which he said investors should keep in mind when looking for actionable strategies.

According to Beaty, moments of chaos tend to represent good buying opportunities.

“When everybody’s crying in the street, and there’s fear and there’s hate for this sector, that’s the time to be buying — and really that’s what I’ve built my career around,” he said.

The expert stressed how important it is for investors to not be too caught up in the moment, whether good or bad.

“To me that’s one of the biggest trends that investors have to remember in this industry: Things don’t stay good forever and things don’t stay bad forever,” Beaty said.

Current market conditions offer good buying opportunity

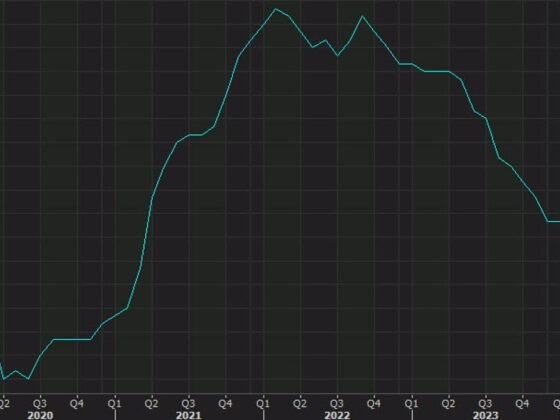

While discussing the progress of the resource space, Beaty did not mince words, calling 2022 an “absolutely godawful year,” both for metals and companies working in the mining sector.

The expert pondered why there was a disparity between the market’s positive fundamentals and its performance.

“Last year and even now it’s a great time to be buying equities, because we are through a bear market and I think we’re going into a really fabulous bull market where we could have an explosive rally in the juniors … this could be a historic time coming up,” he said.

Watch the Investing News Network’s VRIC interview with Beaty above.

The expert stressed that he still thinks mining equities are bewilderingly undervalued.

“In all of my career, I don’t think there’s been a more interesting time than right now for mining and mining metals,” he said.

“There are synchronous bullish conditions for virtually all metals — not every single metal, but almost all metals — today … Just about every single metal in the periodic table is in a good place right now where people want them, demand is increasing … so you have this wonderful, wonderful time today when almost all metals are in a bullish trend,” Beaty added.

As a follow up, he said metals stocks struggled in 2022 with only a “little bit of money flowing.” However, he is confident that a great rally will be coming soon. “I just think it’s a coil spring right now,” he said.

Beaty was equally bullish in a conversation with the Investing News Network at VRIC.

“It could really be a fun market this year for equity investors in these juniors that have been so beaten up, that have delivered such terrible returns in the last few years to the poor suffering investors who got into them,” he said.