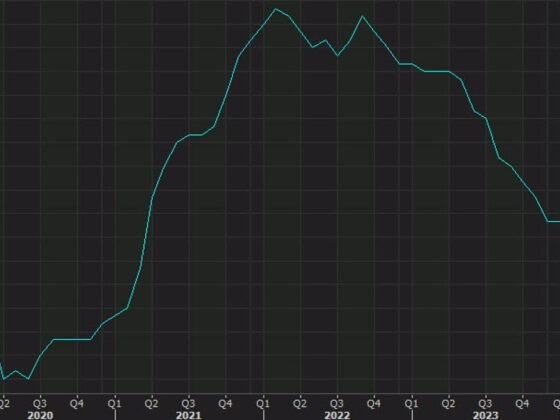

Yes Bank Ltd is one of the stocks in focus in March as the 3-Year lock-in period is coming to an end as well as developments related to the AT1 bonds case. The banking stock, which was trading more than 2% lower at ₹16 apiece on the BSE in Wednesday’s early deals, has declined over 9% in the last five trading sessions.

As a part of RBI’s Reconstruction Scheme 2020, State Bank of India (SBI) initially infused capital of ₹6,050 crore for a ~48% stake in Yes Bank which contained a lock-in period of 3 years till March 2023 for all investors where-in no one can sell old shares in secondary market for 3 years.

SBI’s original 48% stake has reduced to 26% as of December 2022 and the three-year lock-in period of SBI ended last week. Similarly, the three-year lock-in period of other banks, namely Axis Bank, IDFC First Bank, ICICI Bank, HDFC Bank, and Kotak Mahindra Bank, among others, will end on March 13, 2023.

“We expect Yes Bank share price to remain volatile as the lock-in (prohibiting shares sale) ends tentatively in a week’s time by 13th March 2023 as cash transfer happened on 14th March 2020. Near term risk include decision to write-down AT-1 bonds being challenged in Court which is stayed currently and supply overhang post expiry of stock lock-in around March 2023. Consistent with controlled asset quality holds key for stock,” said ICICIDirect in a note last week.

AT1 bonds case

The Supreme Court on Friday put on hold the implementation of the Bombay High Court (HC) order that quashed Yes Bank Ltd’s decision to write off additional tier-one (AT1) bonds worth ₹8,400 crore.

Admitting the petition, a bench headed by Chief Justice of India Dhananjaya Y. Chandrachud issued notice to the bondholders of Yes Bank Ltd after the private lender and Reserve Bank of India (RBI) challenged the January ruling of the HC.

On January 20, the HC had stayed the order for six weeks and on Friday, the SC extended the HC’s stay until further orders. Yes Bank had in March 2020 written off AT-1 bonds as part of a reconstruction scheme.

Yes Bank is a private sector bank with a footprint of 1145 branches across India. Recently, the bank has concluded sale of its stressed assets loan portfolio to JC Flowers.

The views and recommendations made above are those of individual analysts or broking companies, and not of Mint.