The euro has rebounded on Thursday after sliding 1.5% a day earlier, its worst daily showing since September 2022. In the European session, EUR/USD is trading at 1.0613, up 0.35%.

The financial markets are in turmoil, with fears growing that the Silicon Valley collapse could lead to a full-blown banking crisis. Stock markets have fallen sharply and global banks took a hit on Wednesday after Credit Suisse stocks plunged by 25%. Credit Suisse dragged the euro sharply lower and US Treasury yields and eurozone bond also tumbled. Investors are understandably jittery and the lack of any action from the authorities is not helping matters.

ECB meets in midst of market turmoil

How will this volatile situation impact on the ECB decision later today? Given all the market turmoil, it’s anyone’s guess what ECB policy makers will do. Just last week, the markets had priced in an 85% chance of a 50 basis-point increase, but that has been shaved to 25 bp since the SVB collapse. ECB President Lagarde had signalled very clearly that the central bank would raise rates by 50 bp, and if the ECB doesn’t deliver it risks damaging credibility. A pause in rates is unlikely, but given the ugly economic backdrop, such a move cannot be discounted.

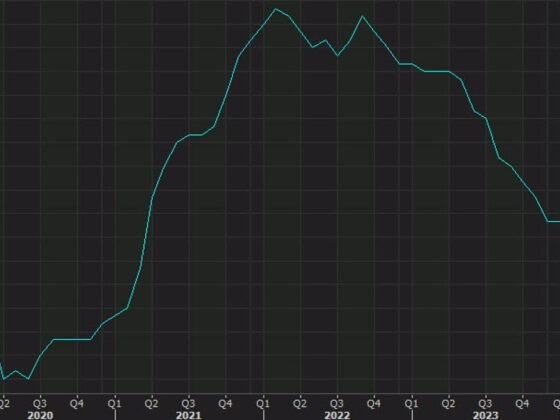

Inflation in the eurozone is red-hot at 8.50% and remains the ECB’s number one concern. The current banking crisis may have shifted attention away from inflation, but the ECB will have to continue raising rates to bring inflation closer to the 2% target. The current market turmoil could lead the ECB to be more cautious at today’s meeting, but I expect that policy makers won’t shift their aggressive rate policy. The ECB will release an updated inflation forecast at the meeting, and if, as expected, the core rate projection is revised upwards, hawkish policy members at the ECB will be calling for more rate hikes.