When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock’s price, but are they really important?

Let’s take a look at what these Wall Street heavyweights have to say about Walt Disney (DIS) before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

Disney currently has an average brokerage recommendation (ABR) of 1.70, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 25 brokerage firms. An ABR of 1.70 approximates between Strong Buy and Buy.

Of the 25 recommendations that derive the current ABR, 16 are Strong Buy and two are Buy. Strong Buy and Buy respectively account for 64% and 8% of all recommendations.

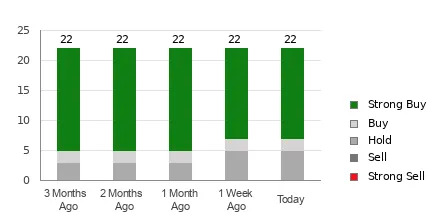

Brokerage Recommendation Trends for DIS

Check price target & stock forecast for Disney here>>>

The ABR suggests buying Disney but making an investment decision solely based on this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock’s future price movement. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements.